What the U.S. Climate Law Means for International Trade

US President Joe Biden signed a climate bill with global implications for international trade. The roughly $370 billion in federal financing would significantly impact critical sectors, such as home appliances, transportation, and energy.

For over a decade, economists in the United States have tried to combat climate change with the idea of a carbon tax. However, the recently approved Inflation Reduction Act (IRA) takes a different approach: it tries to make green technologies affordable. For instance, it assigns more than $57 billion to assist under served communities in electrifying home appliances and transportation.

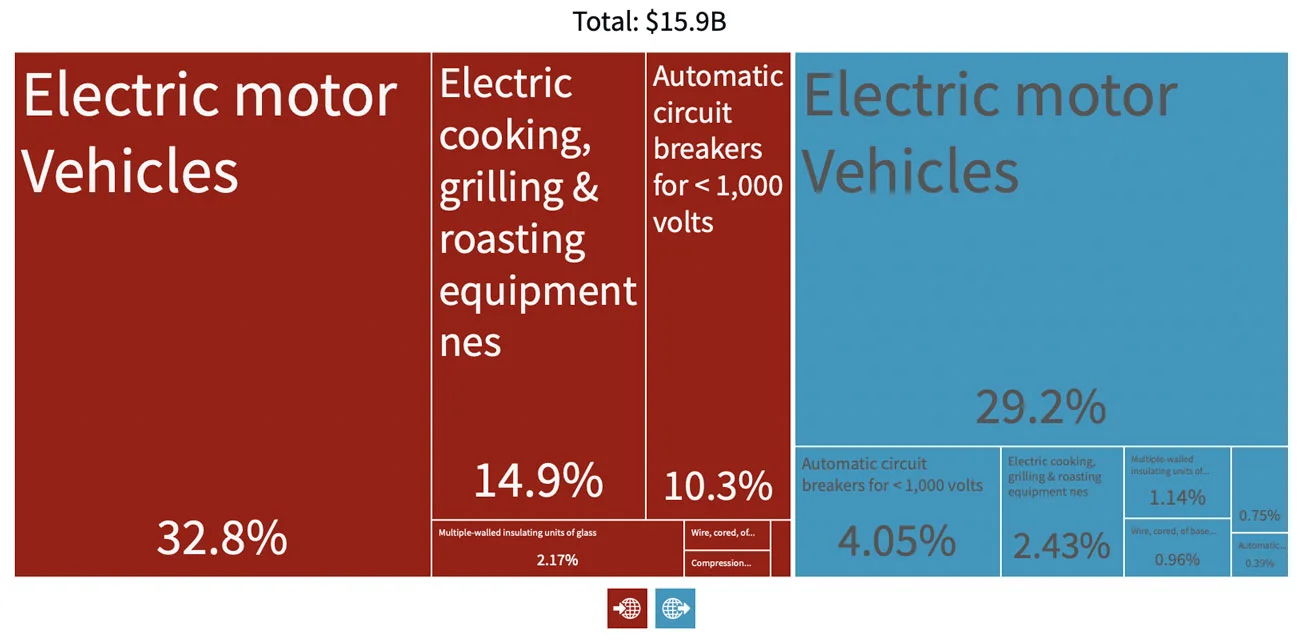

The climate law includes subsidies for heat pumps, reversible “air conditioners” that support heating and cooling, electric cars, and electric stoves. Financial incentives are also available for solar panels, electric batteries, insulation and sealing materials, and the breaker boxes andwires required to build an electric infrastructure at home. But how will people in the United States procure these products? And what is the potential impact of this bill on international trade?

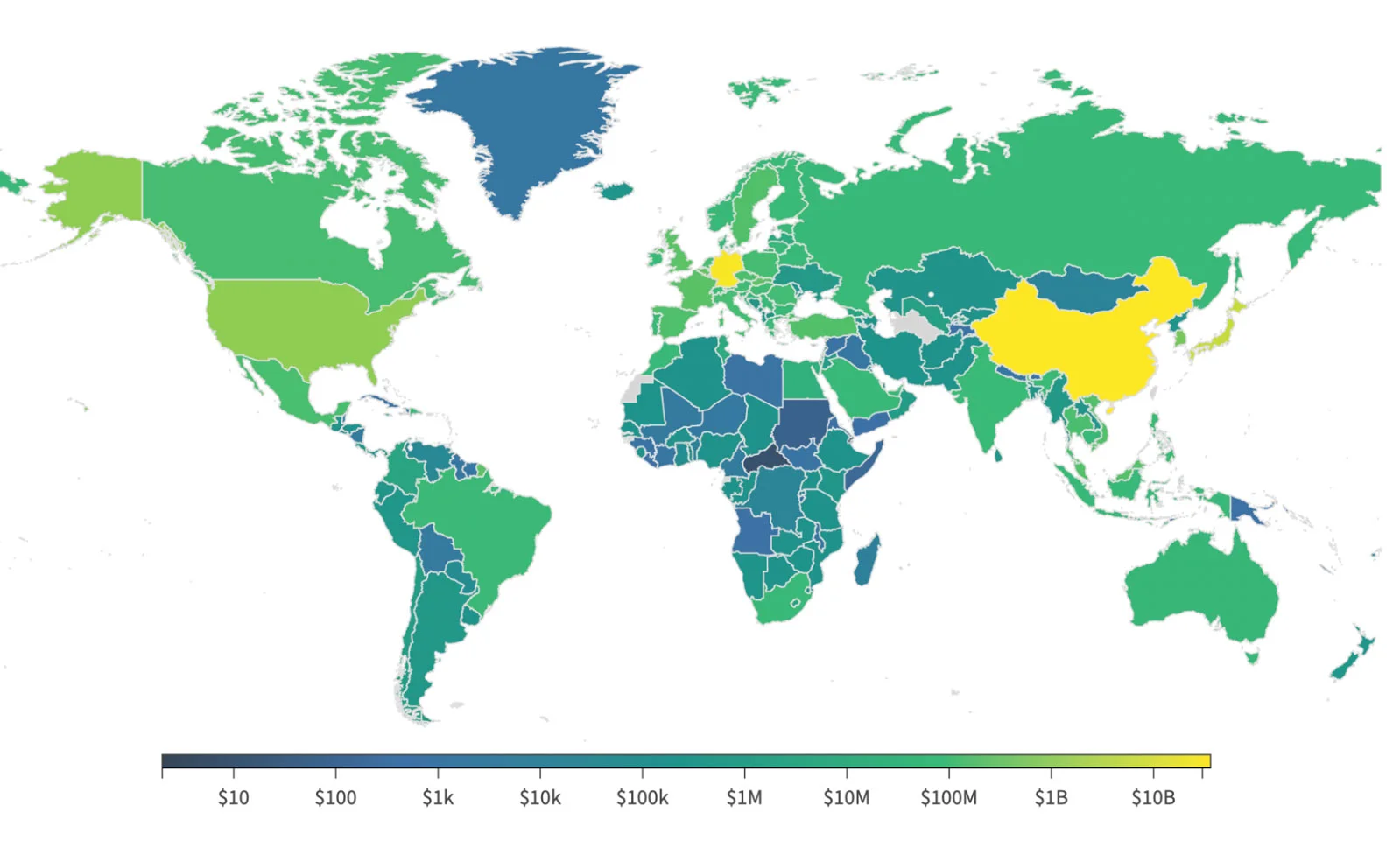

Exports of green technologies have surged between 2019 and 2020, with exports of IRA-subsidized products increasing by 25%.

The IRA is expected to push the demand for these goods even further.

Consider heat pumps, which may be one of the best climate-friendly devices you've probably never heard of.

Heat pumps are the cheapest and most efficient way to heat and cool your home. Like refrigerators, heat pumps transfer heat (rather than producing heat) from a cool environment to a warm room. Like an AC, they can be run with their exhaust pointing out of the house in the summer and into the house during winter.

If all single-family homes in the United States adopted heat pumps, the total annual reduction in CO2 emissions would be at least 160 million metric tonnes by 2032. For perspective, these reductions are similar to the yearly emissions of 35 million cars.

But many households cannot afford heat pumps. So the IRA helps make them affordable for underprivileged populations by including $37 billion in heat pumps and other equipment funding. In the United States, there are 30 million low-and-moderate-income households. Installing heat pumps in all of them would cost about $26 billion.

Heat pumps are one of the essential technologies funded by the IRA. But how many of them are traded in the global market?

In 2021, the U.S. exported $119 million in heat pumps and imported $57 million. Most heat pump exports and imports from the U.S. are with Mexico--highlighting the integration of essential value chains between these two countries. For example, the trade flows between Los Angeles, California, and Laredo, Texas, with Tijuana Baja California, are critical.

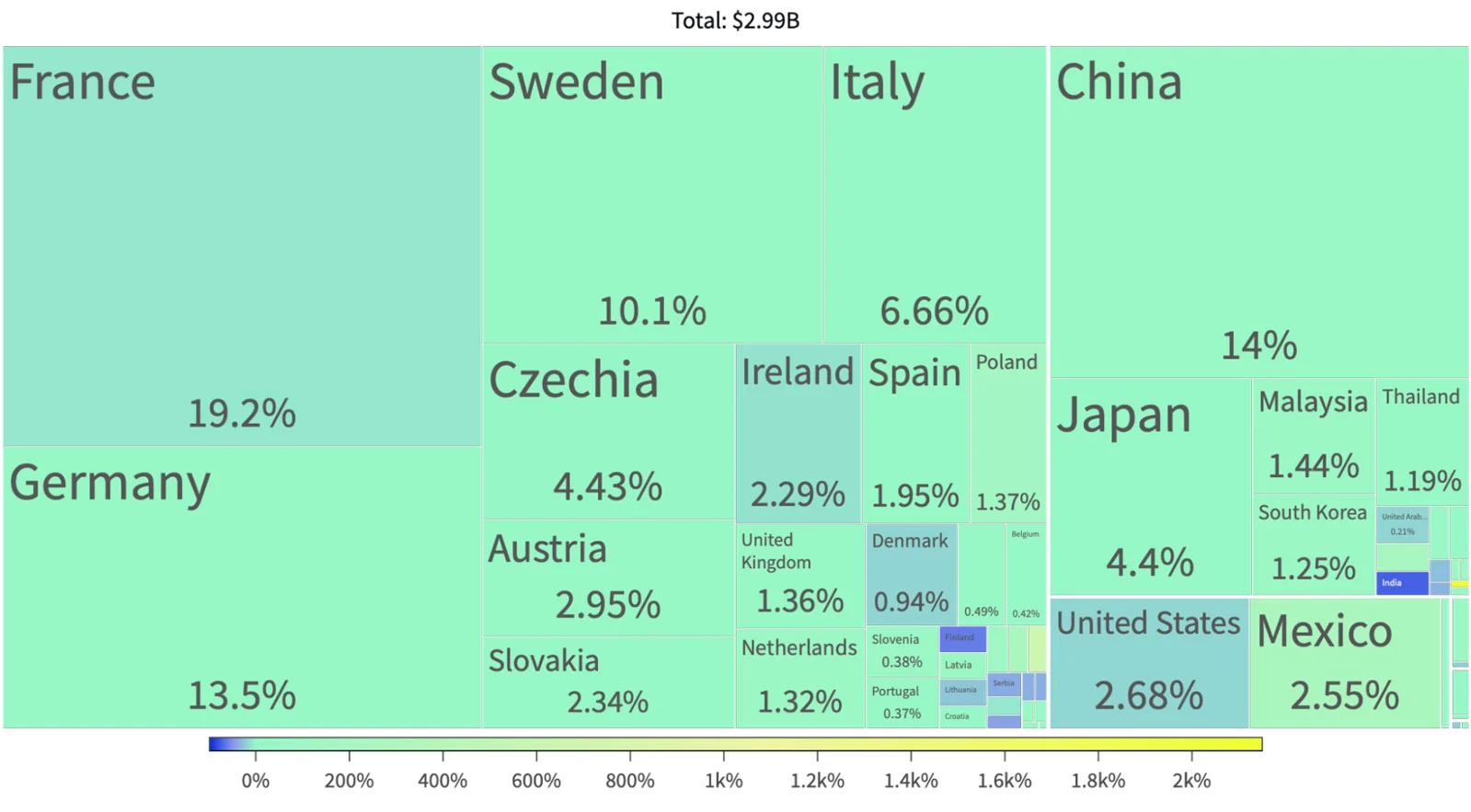

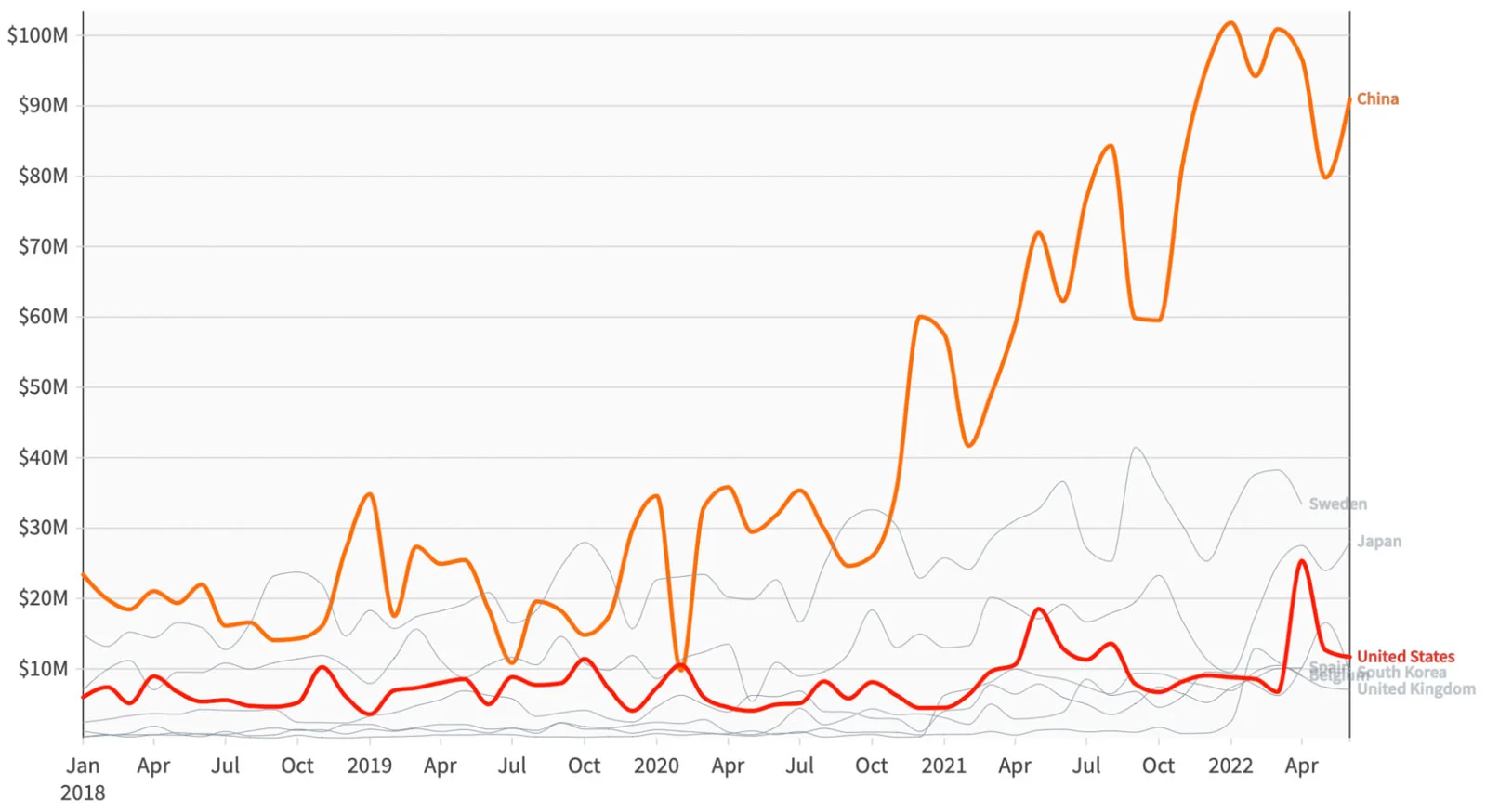

In 2020, France (19.2%), China (14%), and Germany (13.5%) were the countries with more heat pump exports. However, China has subsequently seized control.

Between 2020 and 2021, China's exports increased by 207%, equaling the combined exports of France and Germany in 2020. And they won't stop in 2022. In the first half of the year, China raised heat pump shipments by 165% compared to the first half of 2021.

In 2020, the world - including the United States—shipped $2.9 billion in heat pumps. Last year, the United States and China exported $919 million. So, if millions of houses are to install heat pumps in the next ten years, trade must expand significantly and fast.

The same is true for the remainder of the green technologies subsidized by the IRA. For example, the tax credits for electric vehicles ($36 billion) are more than three times the total value of electric cars exported and imported from the U.S. in 2021. In the instance of electric stoves, the U.S. traded $2.8 billion in 2021, and there are $37 billion in individual clean energy subsidies available.

Yet, some products are notoriously missing from the IRA, such as electric bicycles, which provide an effective commuting alternative that helps combat climate change and congestion.

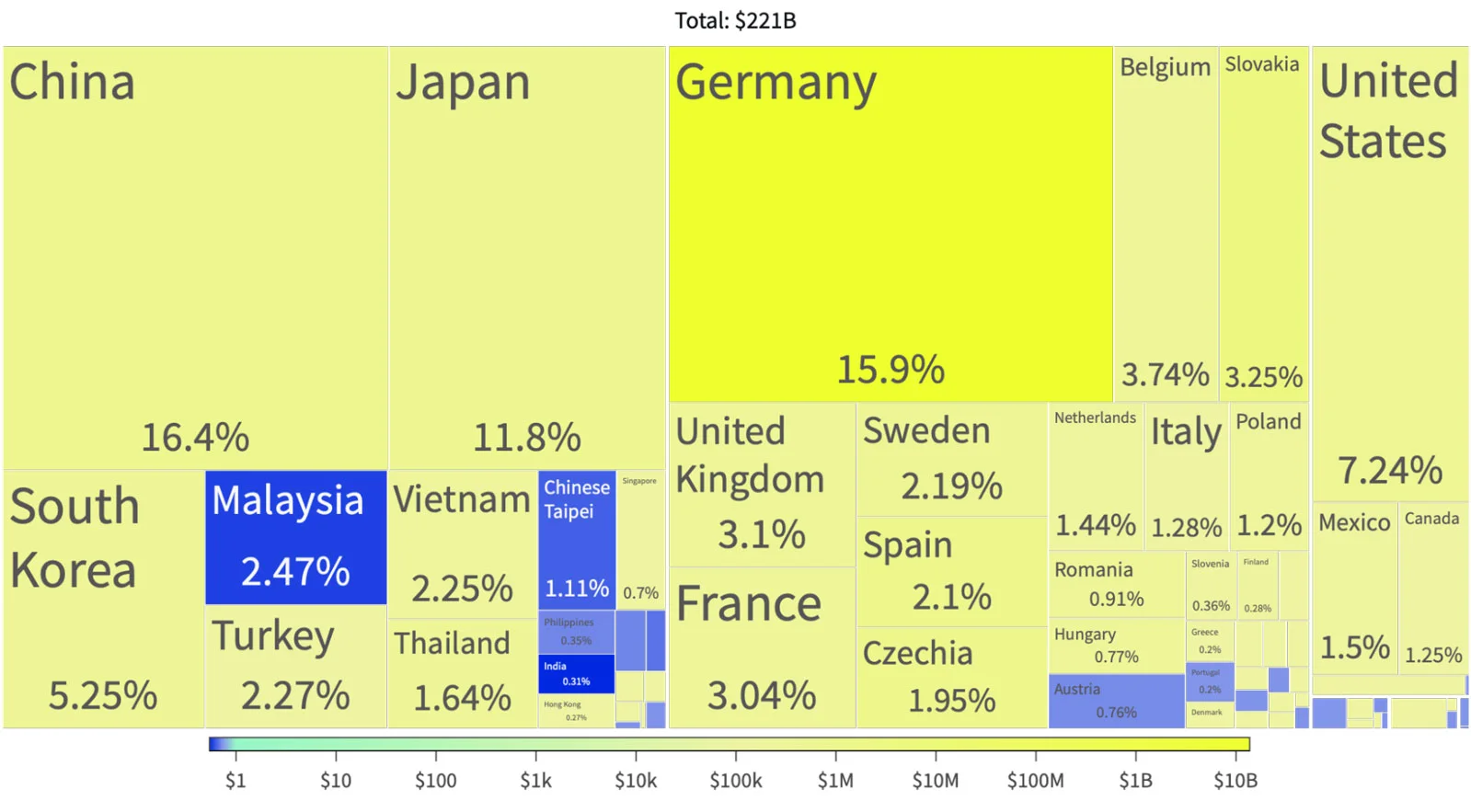

Considering all of the technologies targeted by the IRA, the globe exported $221 billion in IRA-subsidized items in 2020. In other words, the law signed by President Biden invests approximately twice as much in climate-friendly products over the next decade as the globe trades them.

As President Obama concluded, the Inflation Reduction Act is a big deal. The IRA is less about government spending and more about the strength of the market. The tax breaks, loans, and grants are all designed to drive the market to deploy technologies like heat pumps quicker and incentives to make green products competitive.

But its effects are beyond the United States, and that's good news too.

Although the IRA incorporates safeguards to support domestic manufacturing, relying on U.S. manufacturing would not be enough. To be implemented, the IRA will require solid global trade.