2022 Trade Highlights: Record Growth, but a Slowdown in Manufacturing

According to recently released trade data, in 2022, trade registered record highs primarily due to increases in the value of energy and food. Although other industries also grew in trade value, recent trends highlight challenges for several sectors, including electronics, chemical products, and transportation.

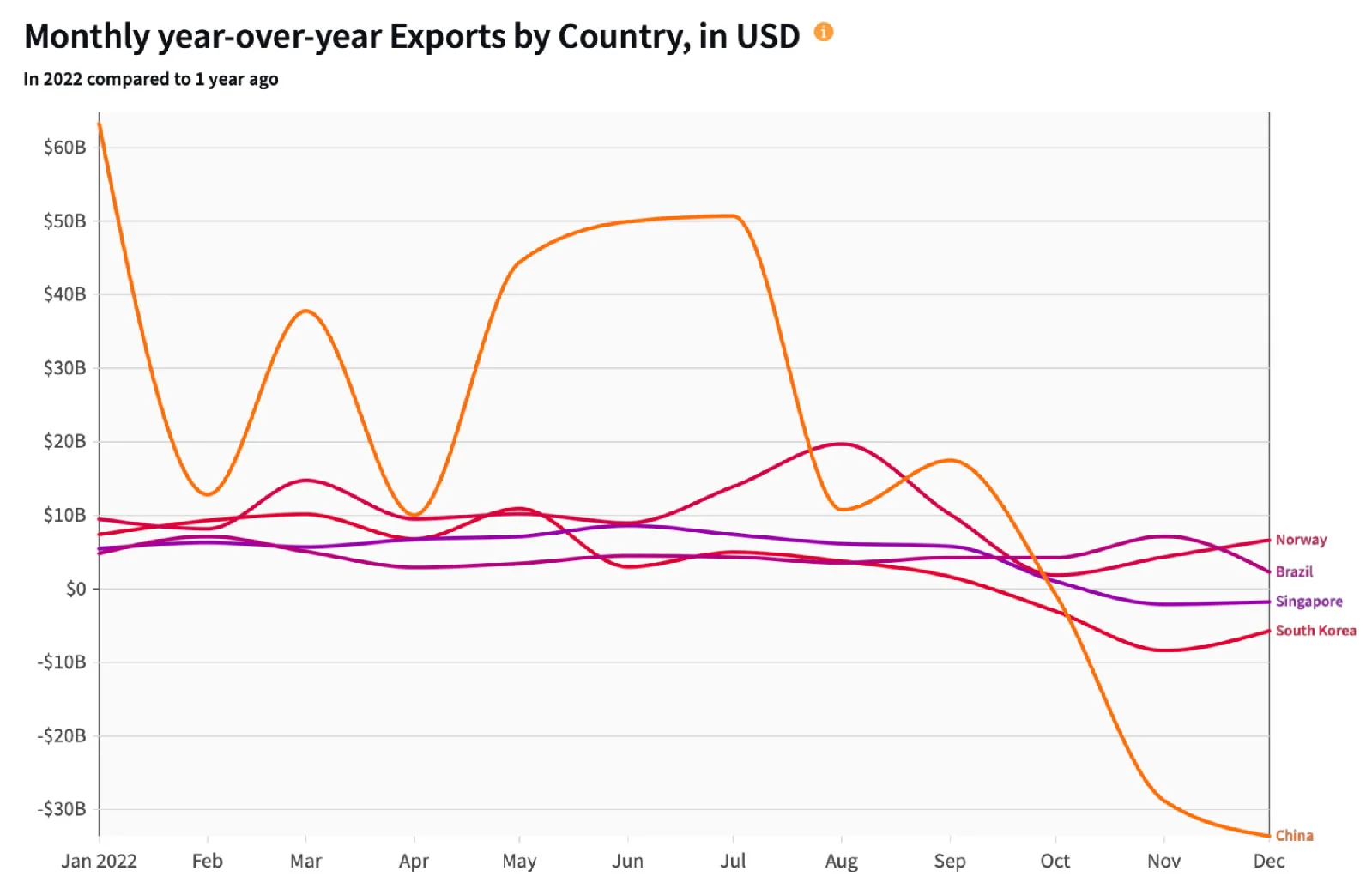

Recently released trade data from China, South Korea, Singapore, Brazil, and Norway show a record amount of nearly US$5.3 trillion in exports for 2022, an increase of about 9% from 2021. The export record is partly due to solid growth in the first half of 2022 and high energy and food prices. In contrast, trade growth slowed in the year's second half, mostly in manufacturing exports. For example, exports of chemical products, machinery, and transportation from China, Singapore, and South Korea fell by around 16% in Q4 2022 compared to Q4 2021.

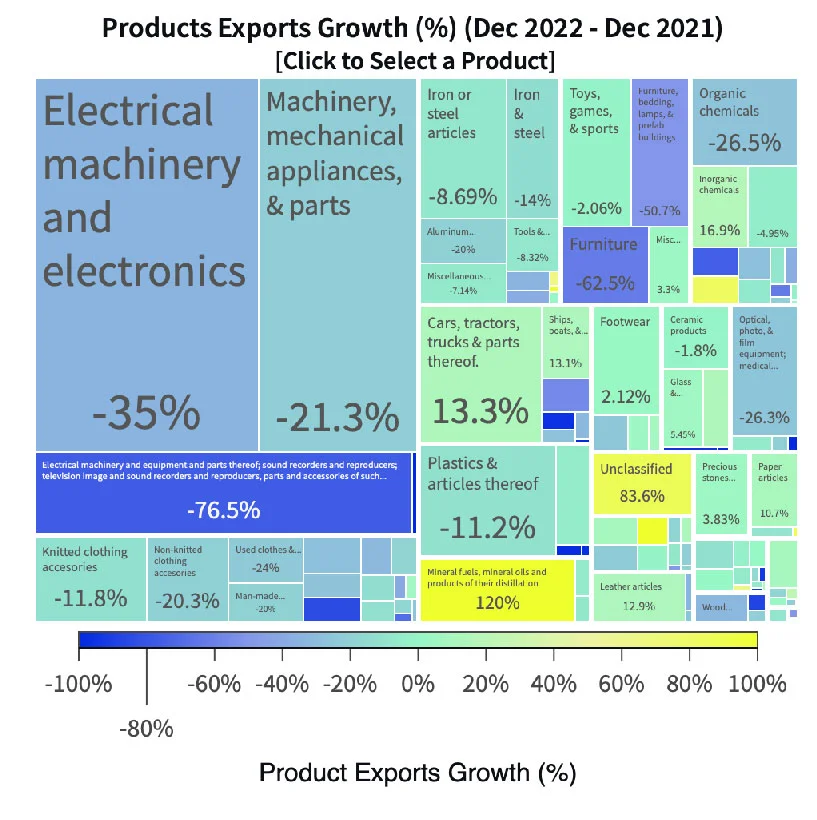

Deteriorating economic conditions resulted in a trade slowdown in the second half of 2022, attributable to slower demand for electronics, particularly semiconductors, medicine, and plastics.

China's latest data, for example, shows this mixed picture, with exports in 2022 6.9% higger than the year before but a decline of almost 8% in exports in the second half of the year. In December 2022, China's exports decreased by $33.6 billion (-9.89%) from $340 billion in December 2021.

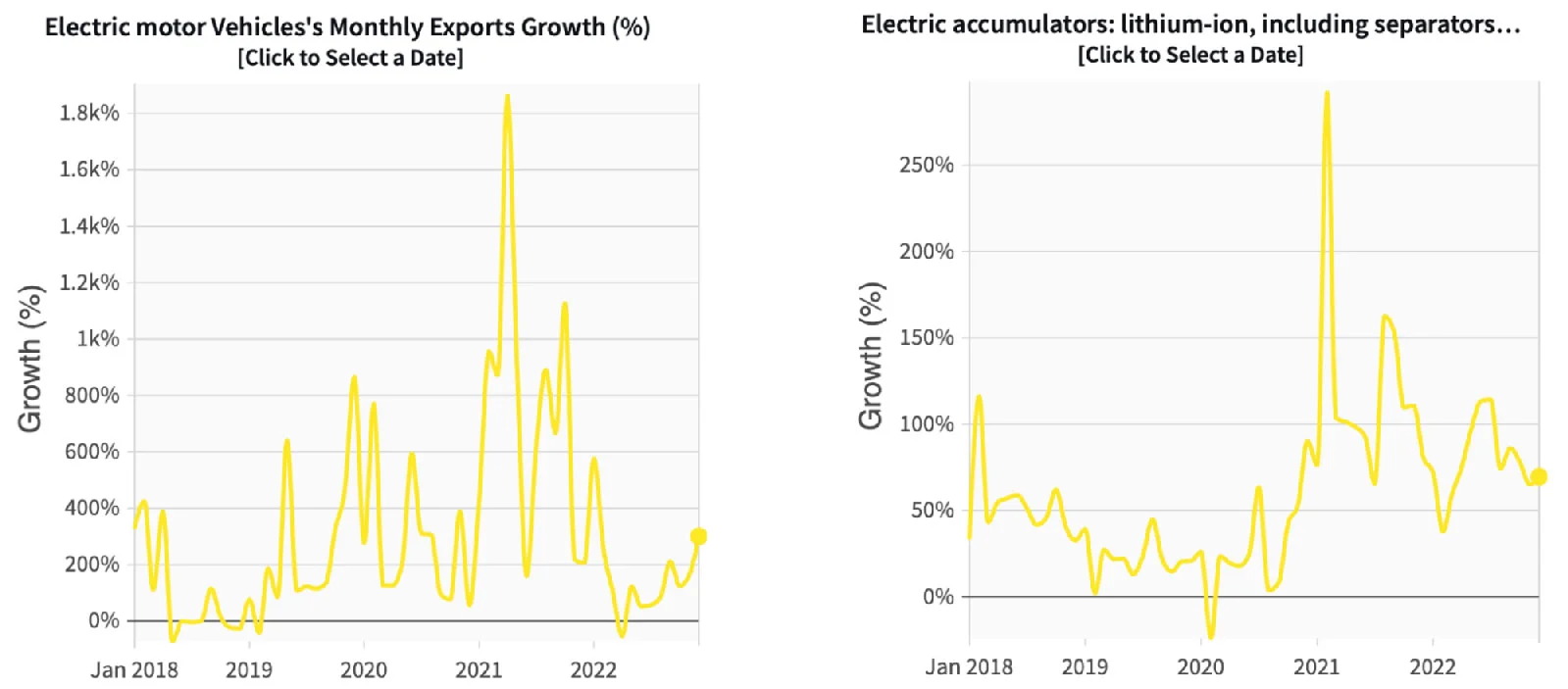

One of the most exciting takeaways from the data is the growth of China's electric car and electric battery exports, which in 2022 skyrocketed by 134% and 63.9%, respectively. This consolidates China's dominance in the electric mobility market and suggests that the country is focusing on strategic industries that hold promise for the future.

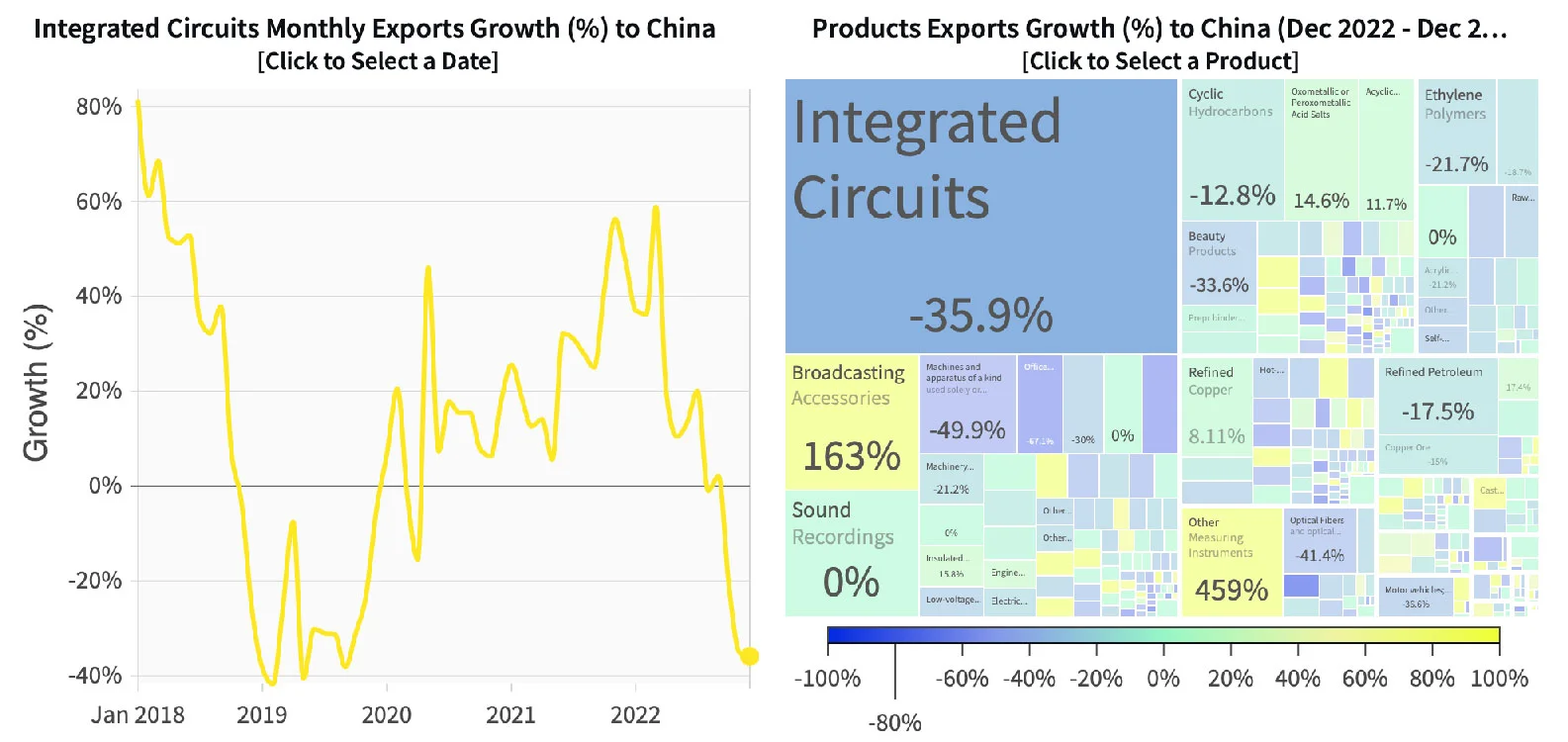

Exports from South Korea increased by 6.1%. However, South Korea's export growth rate turned negative for the third consecutive month in December, with a decline of 9.3% compared to the previous year. The decline is mainly driven by a fall in crucial integrated circuit shipments and weakened trade with China.

Integrated circuits make up around 17% of South Korea's total exports, while China is South Korea's principal market, with 43% of total exports. So, recent trade trends are a cause for concern for the country's economy.

South Korea's exports of integrated circuits to China have decreased for four consecutive months, a total decline of almost 4% in 2022 compared to 2021. However, integrated circuit exports to Singapore, India, and the U.S. increased in 2022 by 43%, 29%, and 14%, respectively.

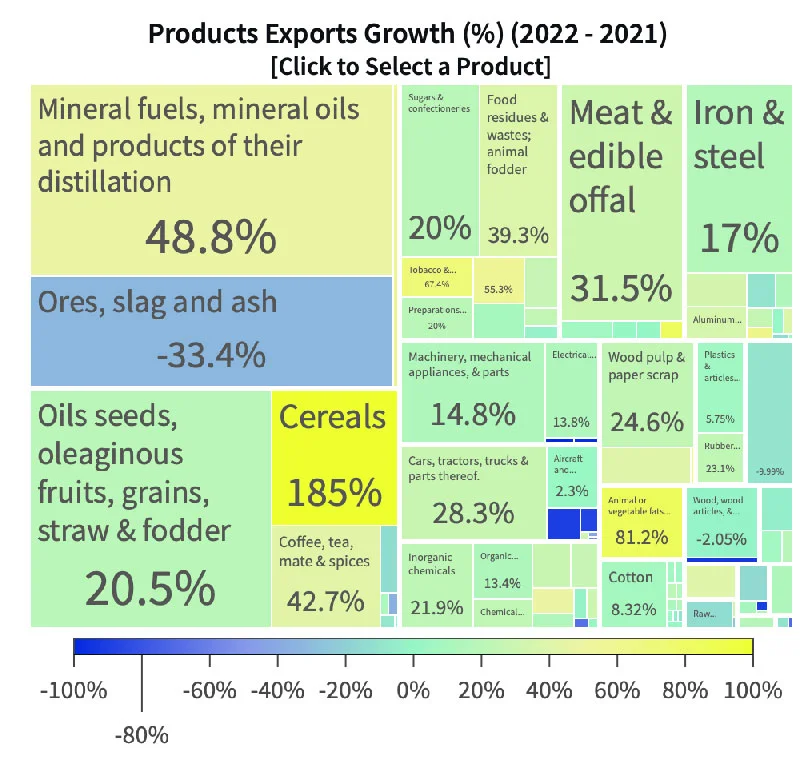

On the other hand, commodity exporters like Brazil and Norway continue to show a strong performance. Exports from Brazil, for example, reached a record high of $335 billion in 2022, a 19.3% growth from the year before. A boost in prices of commodities such as cereals, soybeans, meat, metals, and crude oil drove exports. In 2022, these commodities represented more than 50% of Brazil's exports.

In December alone, exports grew 9.39% compared with the previous year, to $26.6 billion. Exports to China increased by 19.8%, while exports to the U.S. grew by almost 12%. In December, one of the most significant exports increased from aircraft, with a 93% increase. Nearly two-thirds of aircraft exports from Brazil go to the U.S.

Recent trade data of some of the world's significant exporters further illustrate the growth patterns during 2022. While exports were higher a year before, most of the growth came from commodities, while the latest trends reveal a challenging 2023 for manufacturing products.