From Trade Wars to Trench Wars: How Russia's Invasion of Ukraine Disrupted Global Trade

The alliance of Russia and China has been strengthened, yet technological sanctions from NATO+ countries continue to harm Russia.

After Russia invaded Ukraine, NATO+ nations imposed economic sanctions to isolate Russia from the global market. But, almost immediately, Russia found a lifeline in China.

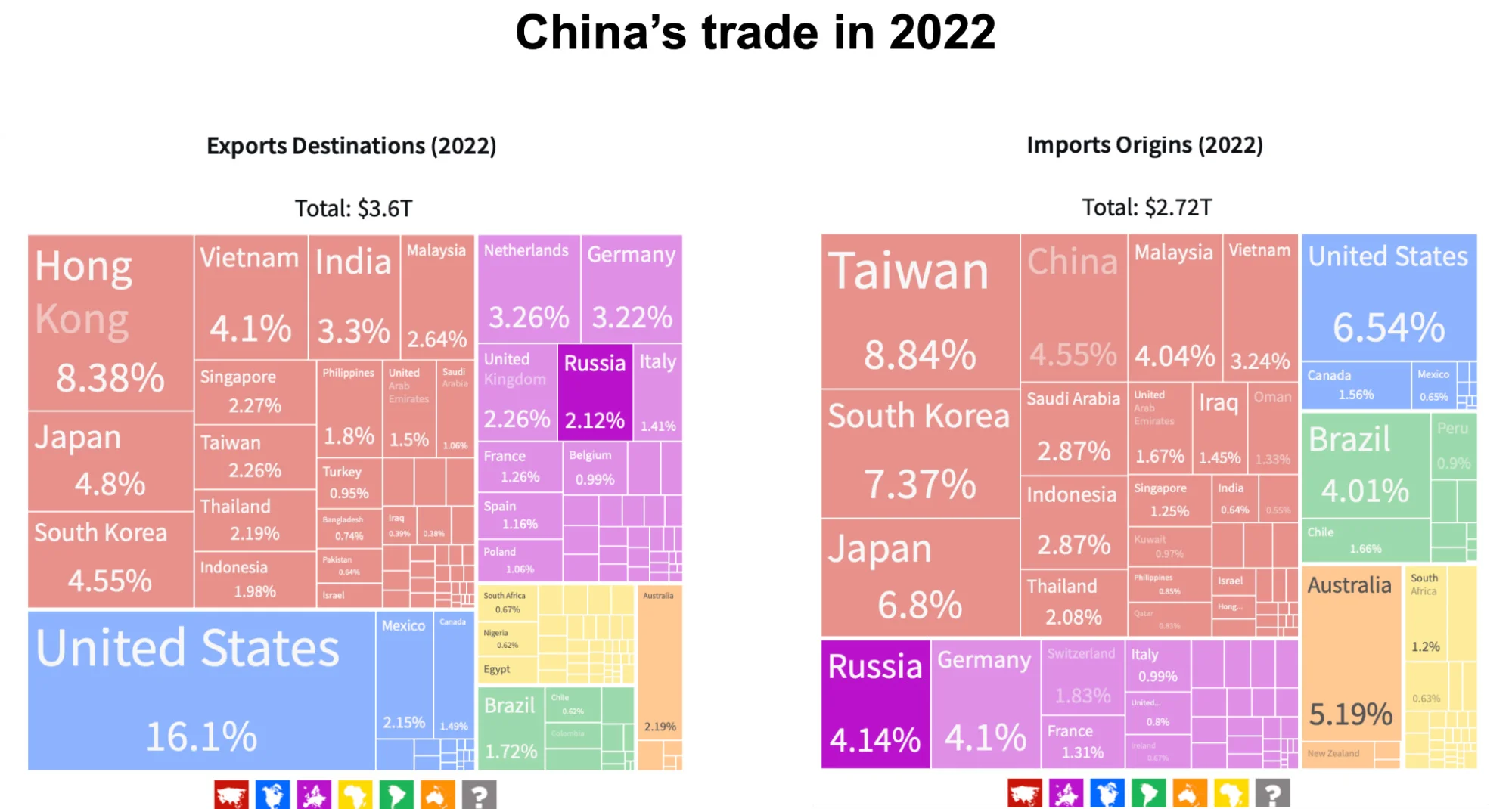

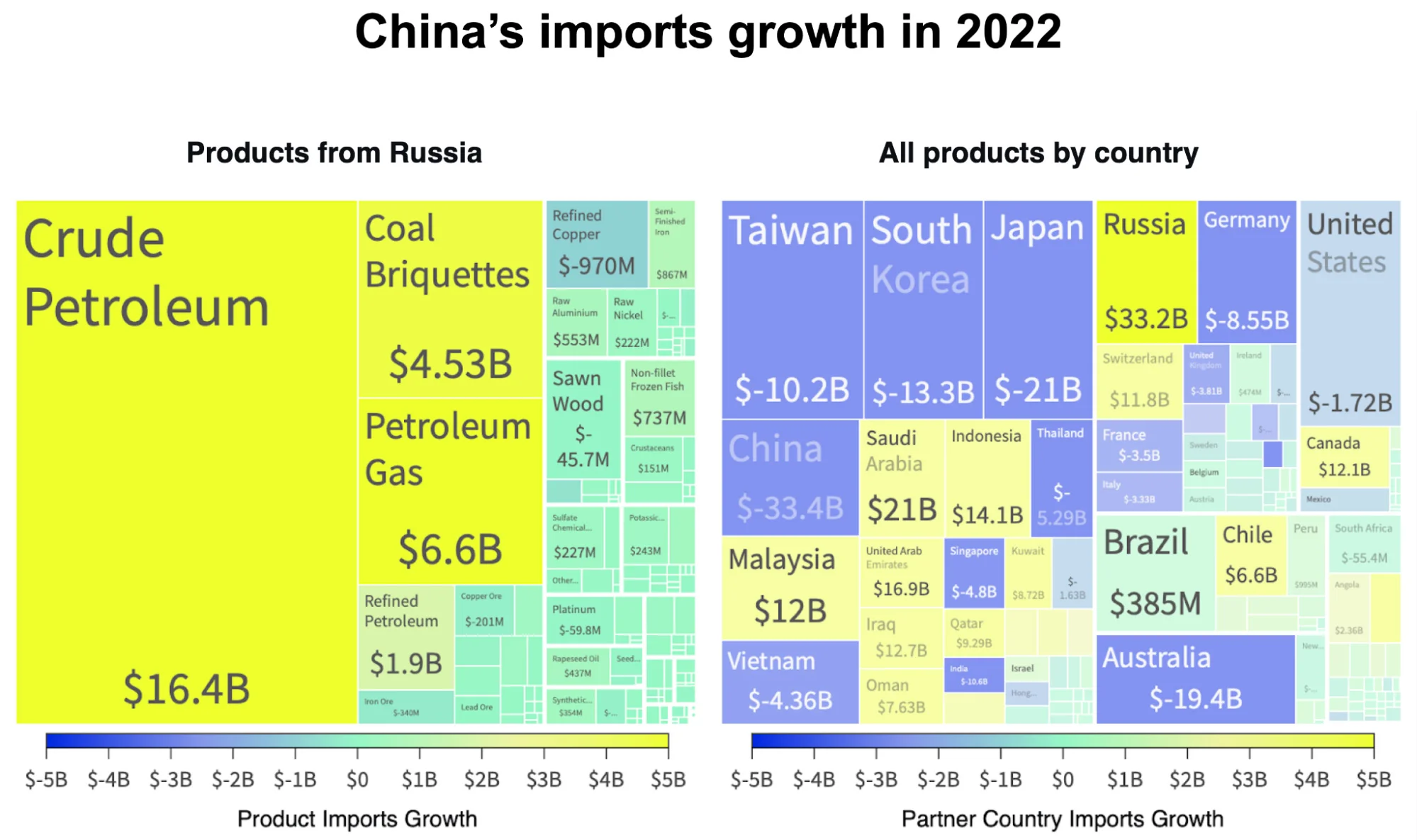

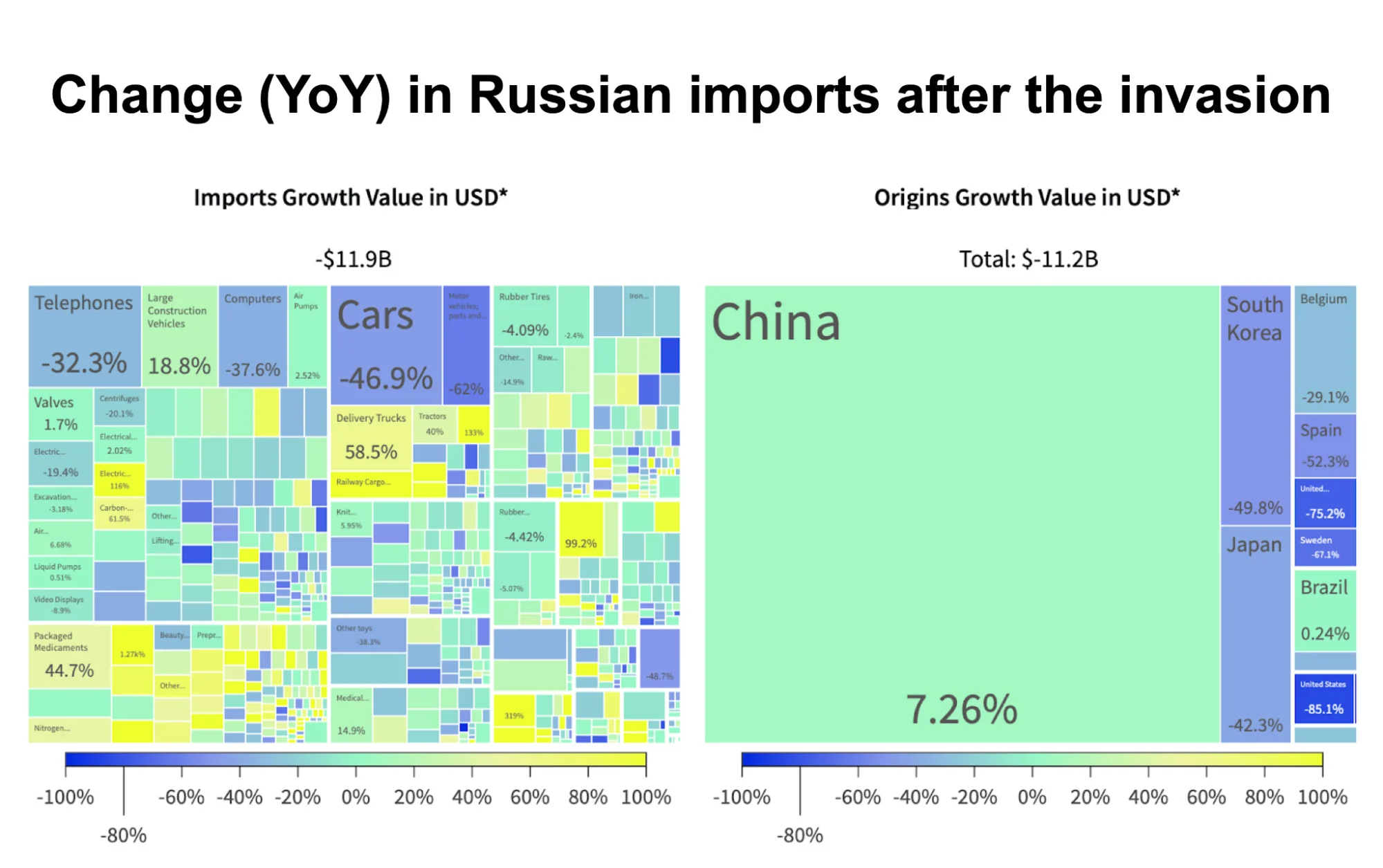

Trade between Russia and China grew by $31.2 billion in the months following the invasion, compared to the same period in 2021. Almost two-thirds of the increase came from oil and gas exports from Russia to China. Although China's exports to Russia have increased by 7.26%, they have not yet compensated for Russia's estrangement from the West.

China's trade with Russia hit a new record of $189.3 billion in 2022, up 22.3% year-on-year. China accounted for almost half of Russia's total trade, while Russia ranked as China's tenth largest trading partner, with a share of nearly 3% in China's global trade.

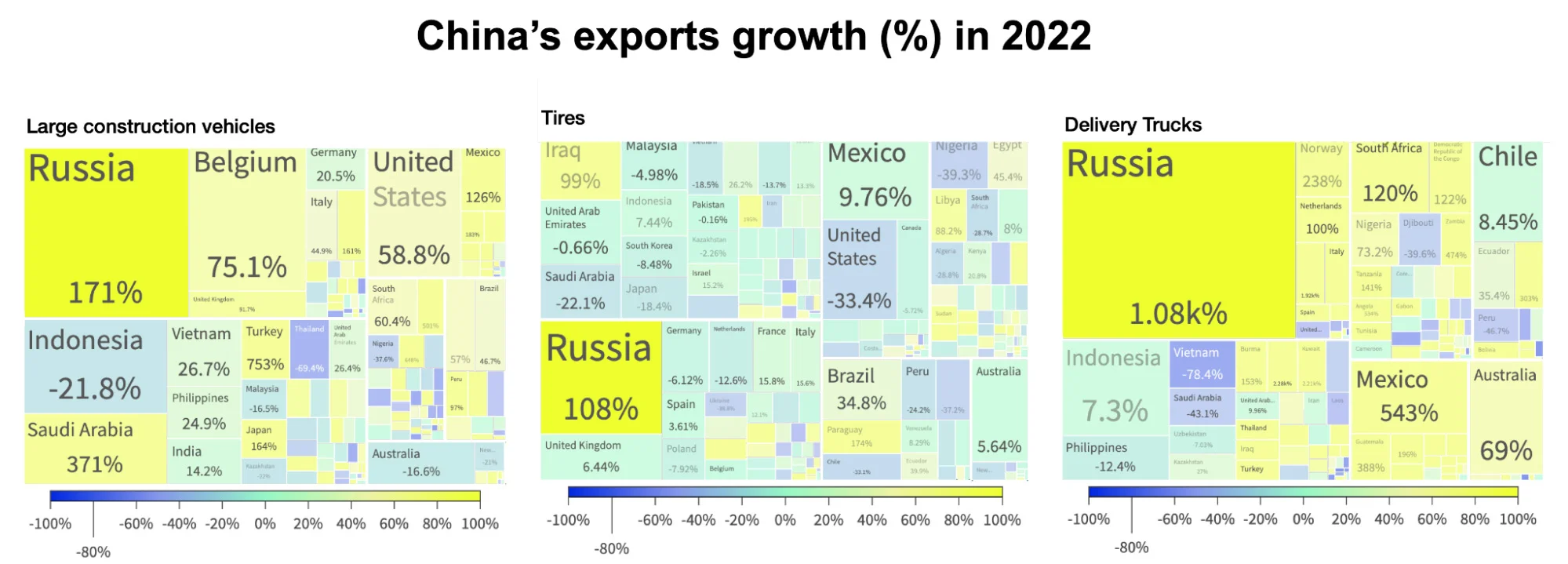

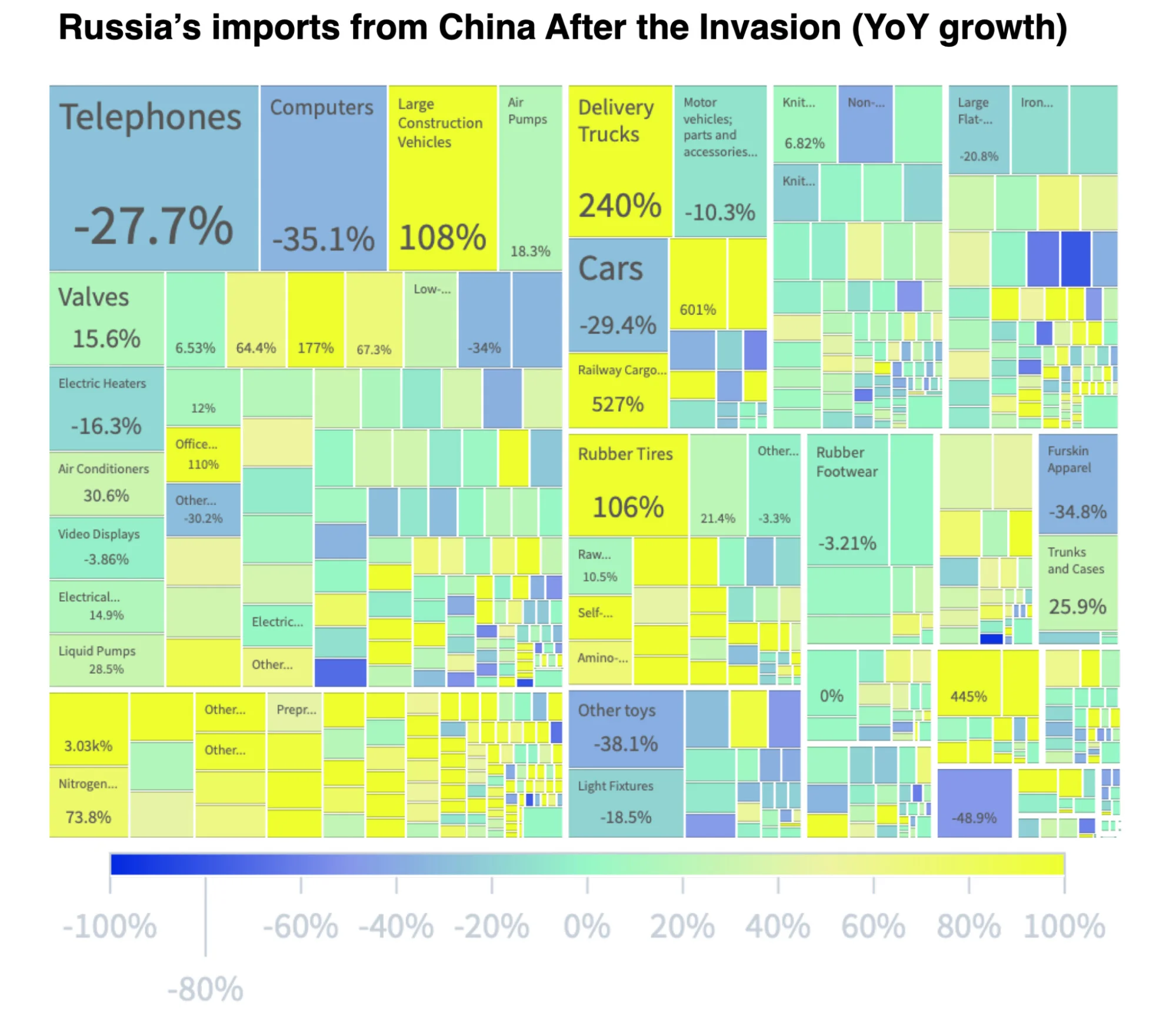

Mechanical appliances (↑ 2.07 billion) and vehicles (↑ 1.63 billion) are some industries that traded more between China and Russia after the invasion. In 2022, China sold over $17 billion to Russia on products such as large trucks (1.7 billion), tires (1.2 billion), and delivery trucks (987 million).

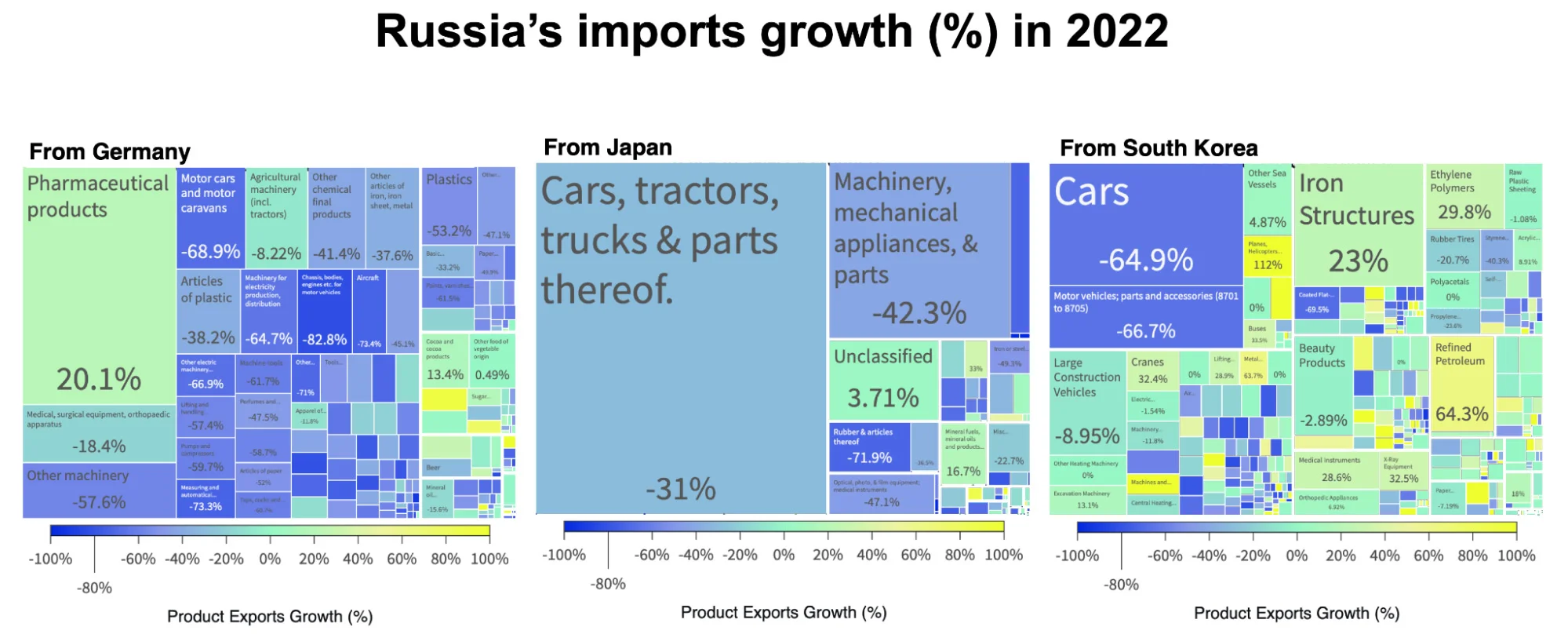

Chinese products have helped Russia substitute some critical technologies without access to suppliers from Europe, particularly Germany, Japan, and South Korea.

Several infrastructure projects, such as the Power of Siberia gas pipeline, the Yamal LNG project, and the Eastern Siberia-Pacific Ocean oil pipeline, have diversified China's mineral fuel supply and helped Russia reduce its reliance on Europe and develop its Far East strategy.

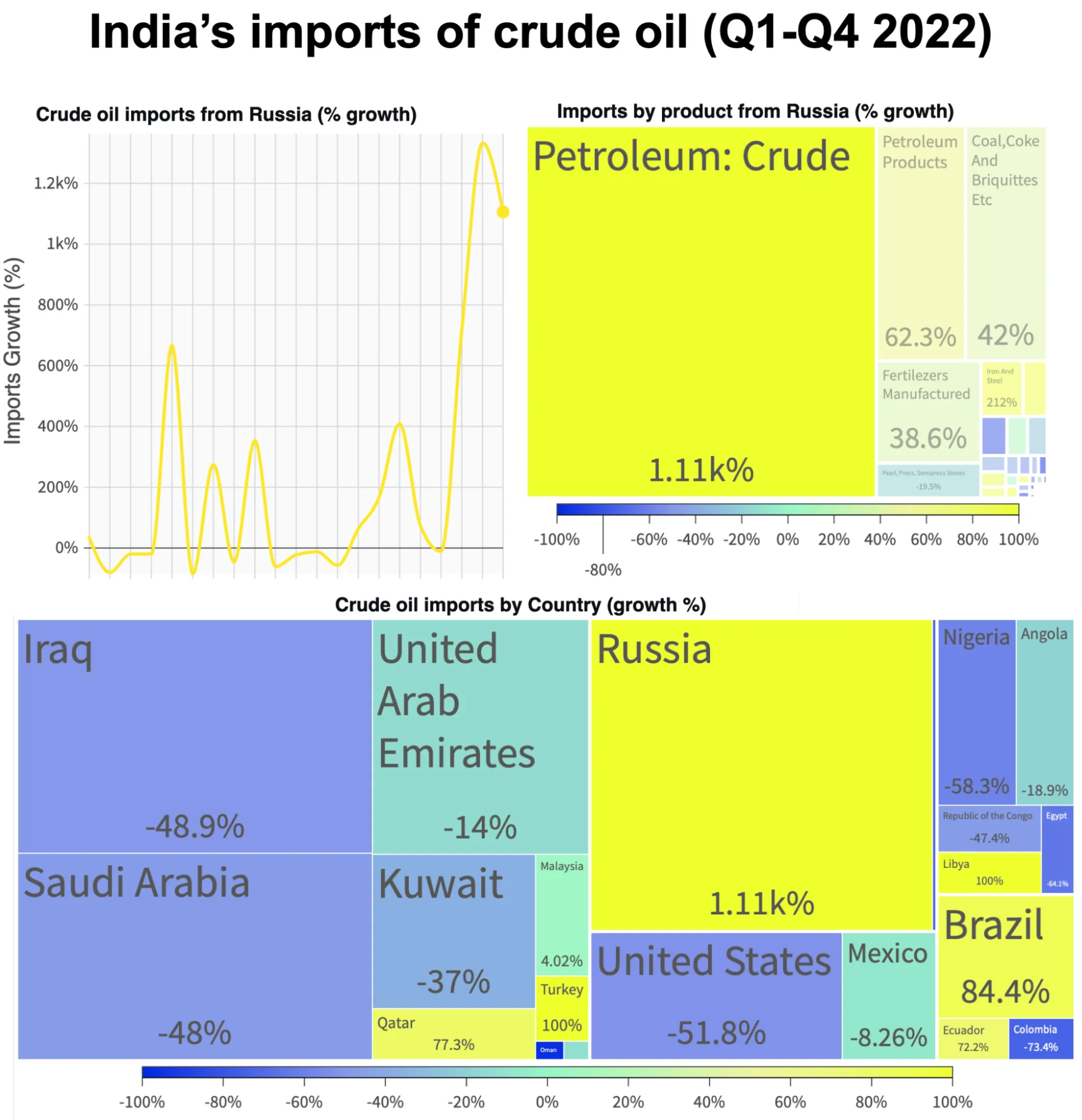

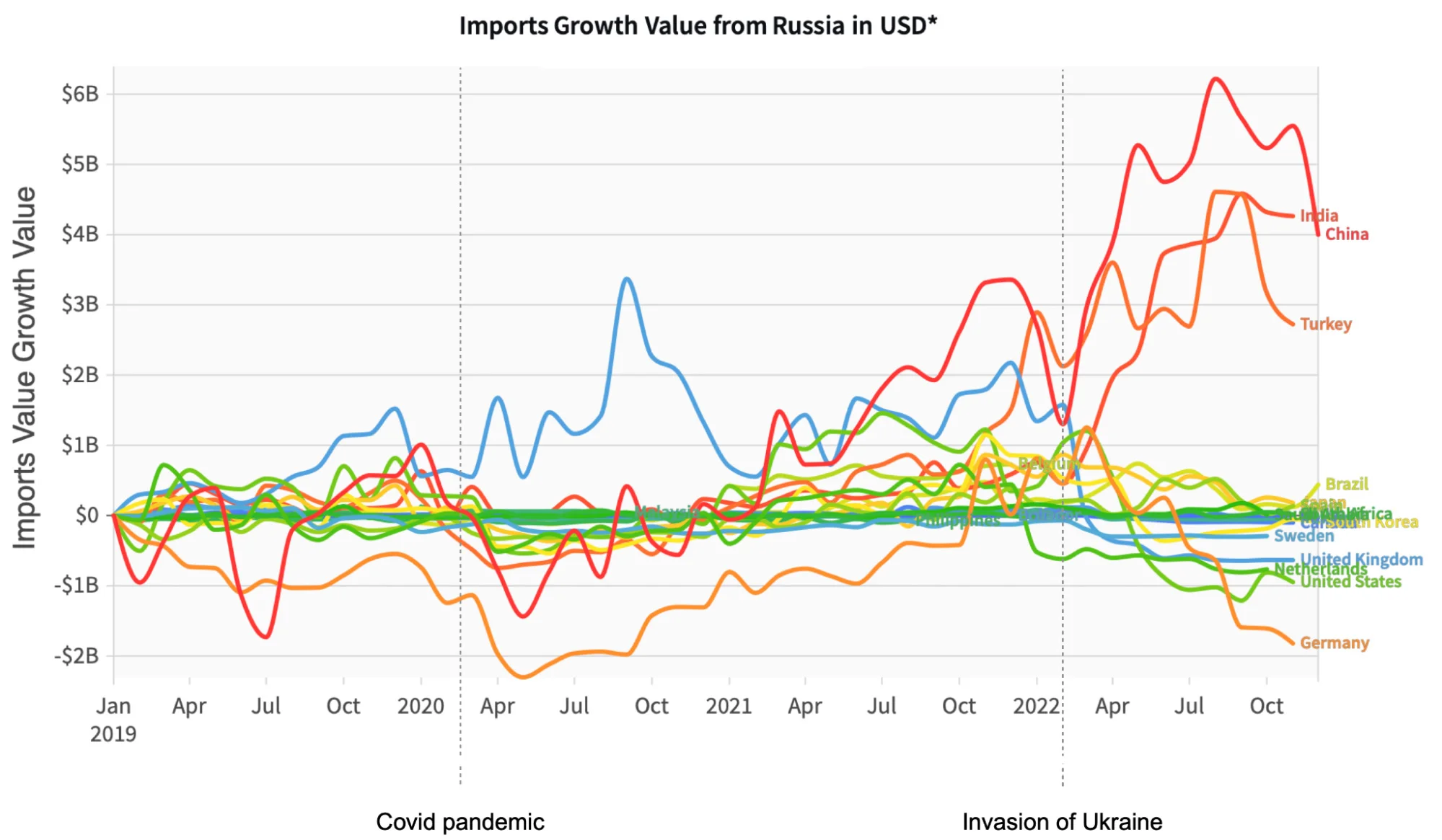

Russia's mineral fuel exports to China rose by 50% in the first months after the invasion –compared to the same period the year before. Belgium (75.4%) and Brazil (46.8%) were other countries that imported more oil from Russia. But it is India, the country with the biggest increase in fossil fuel imports from Russia after the invasion, that has a 1.1K% growth.

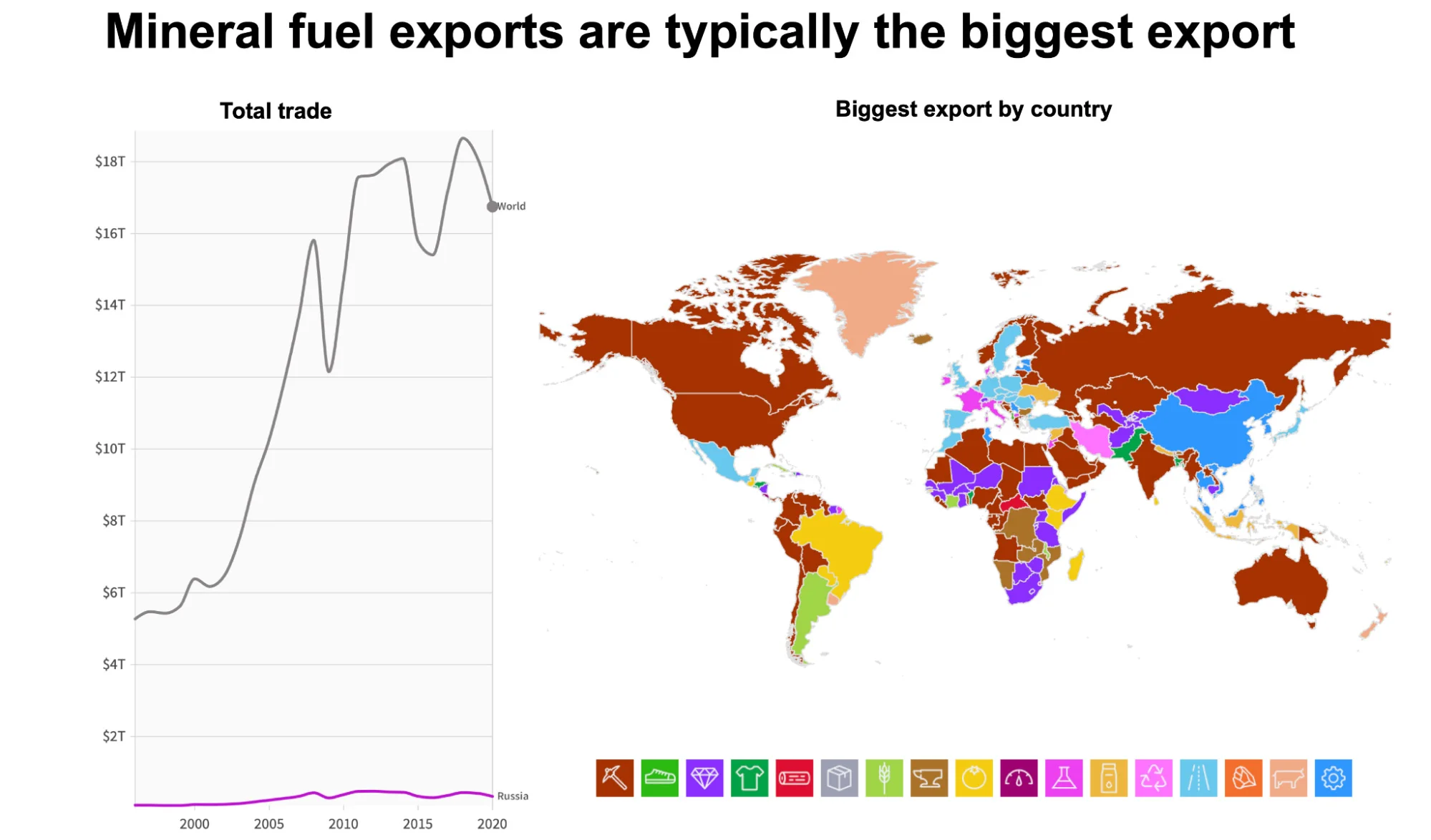

The increase in mineral fuel revenues has been a lifeline for Russia. Russia's budget, which relies heavily on mineral fuel exports, has not shrunk due to the sanctions.

In the months after the invasion, Russian exports grew by over 10 billion compared to the previous year. At the time Germany and other European countries dropped mineral fuels from Russia, markets such as China (↑ $26.4 billion, 50.1%), India (↑ $3.82 billion, 464%), and Turkey (↑ $766 million, 72%) opened.

But mineral fuels have been the primary driver of trade growth between Russia and China, accounting for over half of their trade. China bought record amounts of oil and gas from Russia in 2022, making it China's second-biggest crude oil supplier and third-biggest natural gas supplier.

The rise in mineral fuel exports has played a crucial role in Russia's budget, enabling the country to get critical products. However, Russia's heavy reliance on its oil and gas industry renders it vulnerable.

Most countries also export mineral fuels, making it a more common (or ubiquitous) product. “Ubiquity” means that some products or industries are more widespread than others and can be produced by many countries and companies with similar levels of technology and expertise. This is important for identifying areas of advantage or disadvantage.

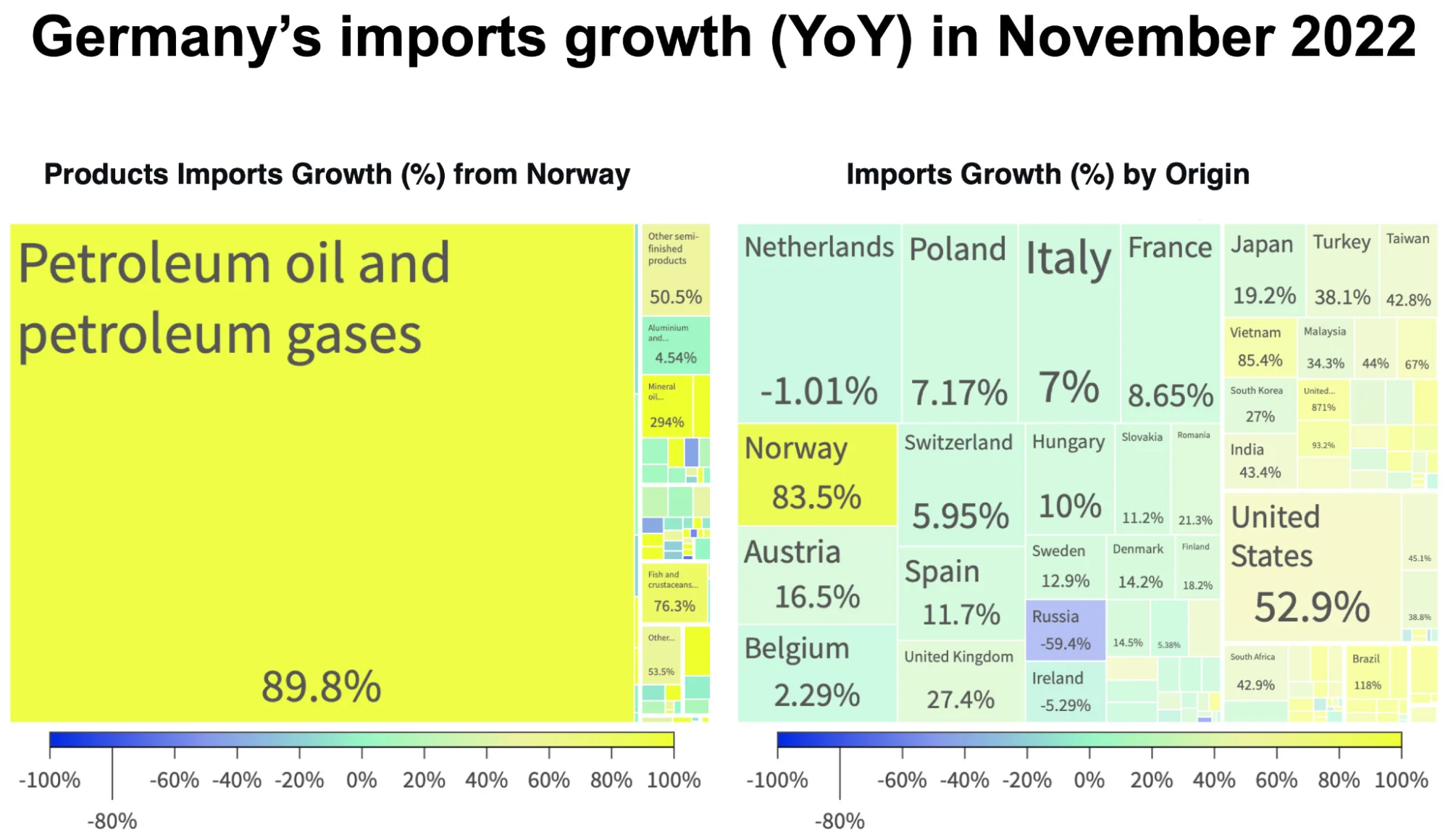

Consequently, countries without access to Russia's mineral fuels have diversified their supply sources or expedited their transition toward renewable energy.

Before the invasion, Russia provided about a third of Europe's natural gas and was Germany's largest supplier of oil and coal. After the invasion, Europe found alternatives to Russian gas from other countries, such as Norway, Qatar, Azerbaijan, Algeria, Egypt, Turkey, Japan, and South Korea. The EU plans to slash imports of Russian gas by two-thirds by 2023.

So, the sanctions have affected Russia by limiting its access to essential products, not by reducing its revenue from mineral fuels.

First, the sanctions restricted Russia's ability to import vital products from Japan, South Korea, Europe, and the U.S. Then, China increased its exports to Russia. However, there is still a long list of products that Russia used to import from NATO+ countries that are yet to be replaced.

Most of China's exports increase is concentrated in certain products, such as delivery trucks (240%), railway cargo containers (527%), tires (106%), and aluminum oxide (7.7K%).

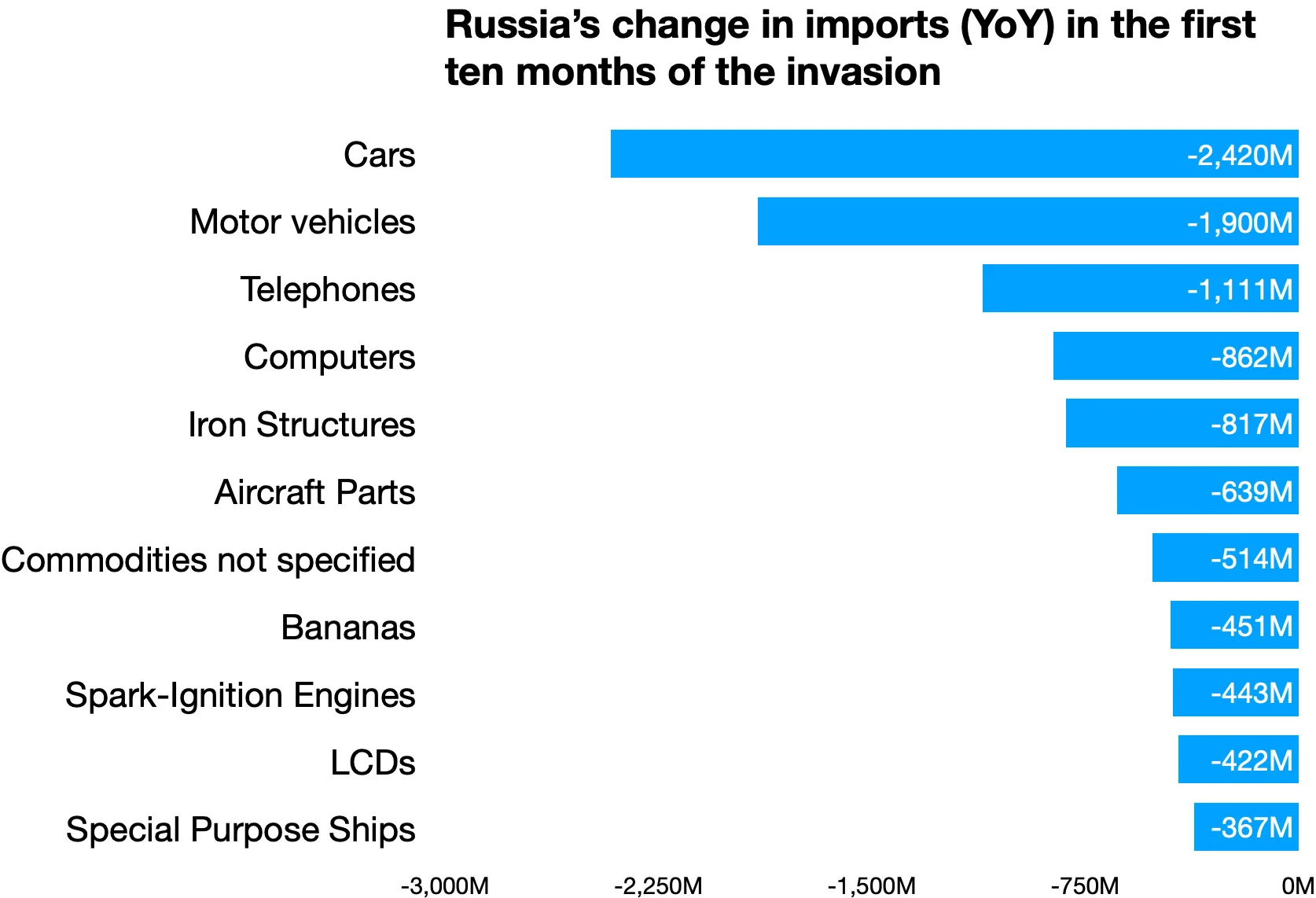

As a result, Russia has struggled to access sensitive technology for defense, aviation, and maritime sectors. For example, Russia's flagship Sukhoi Su-57 stealth fighter jet has been delayed due to problems with its engine design and production.

Consumer goods and services are another areas of decline. Ten months after the invasion, Russia has imported $2.4 billion less in cars, $1.9 billion in motor vehicles, $1.1 billion in telephones, and $862 million in computers than in the same period in the previous year.

Just as Russia's exports are relatively narrow and have a limited impact on the global economy, its imports from China or elsewhere have not yet replaced all the essential products it lost access to from NATO+ countries.

Russia's invasion of Ukraine and the ensuing Ukrainian resistance is the most significant international event of 2022. The invasion had far-reaching consequences beyond the military sphere, such as creating millions of Ukrainian refugees, disrupting food and mineral fuel supplies, and re-making the Russian economy.

The war has disrupted trade patterns, especially for Russia. Many countries have applied trade restrictions on products such as oil, gas, metals, fertilizers, technology, and software. Others have reduced or stopped their trade with Russia voluntarily or due to political pressure. While some countries, such as China, India, and Turkey, have boosted their trade with Russia after the invasion, the gap left by the departure of most international companies has persisted.