The Effects of Climate Change on Brazilian Coffee Exports

Climate change is making your morning cup of coffee more expensive. How much more depends on your taste.

Brazil is the world's largest producer of coffee. The country grows 28% of the world's Robusta crop (bitter, used primarily in instant coffee and espresso), and 41% of Arabica, the beans favored by Starbucks, Dunkin Donuts, and McDonalds. The worst drought the country has seen in a century is affecting production, particularly of Arabica, a crop less resistant to the heat than Robusta.

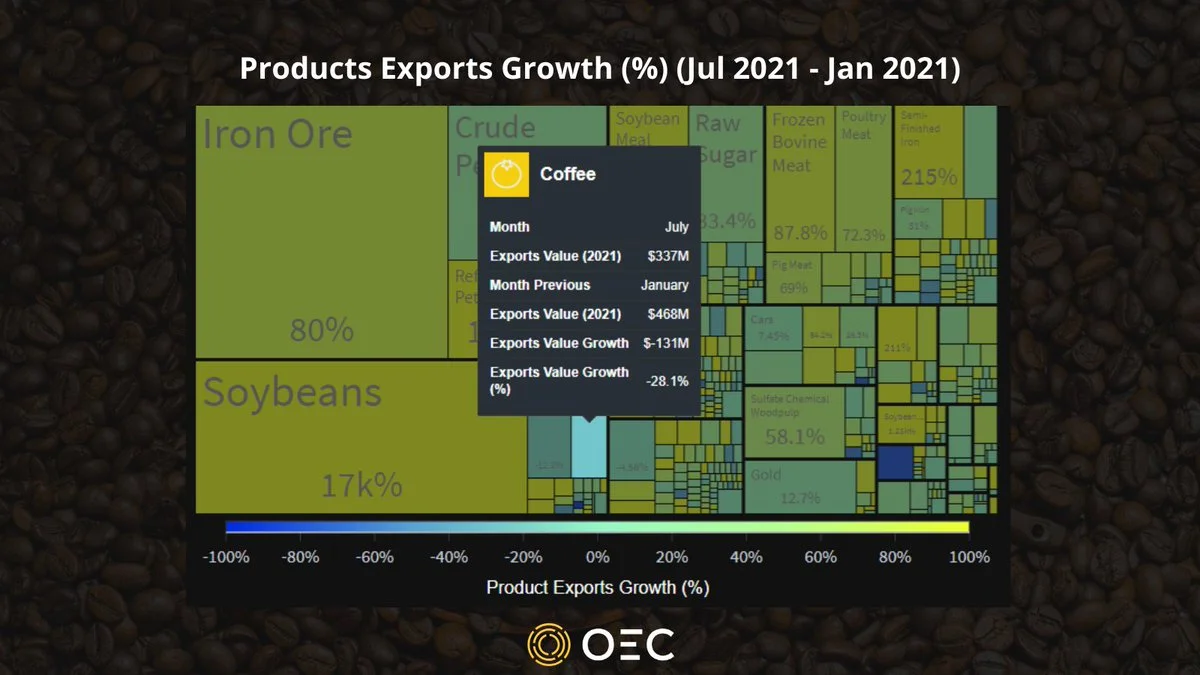

July trade data from Brazil shows how coffee production is already affected by climate change, and suggests how our taste for coffee could evolve in a warmer future.

Coffee is one of the most globally traded commodities, with a total annual trade of $30B in 2019 (1). Two species of coffee, Arabica (70%) and Robusta (30%), account for virtually all production. Robusta can grow in hotter temperatures, and produces more fruit with more caffeine. A study of the global impact of climate change predicts that the area suitable for Arabica coffee will reduce by 50% by 2050.

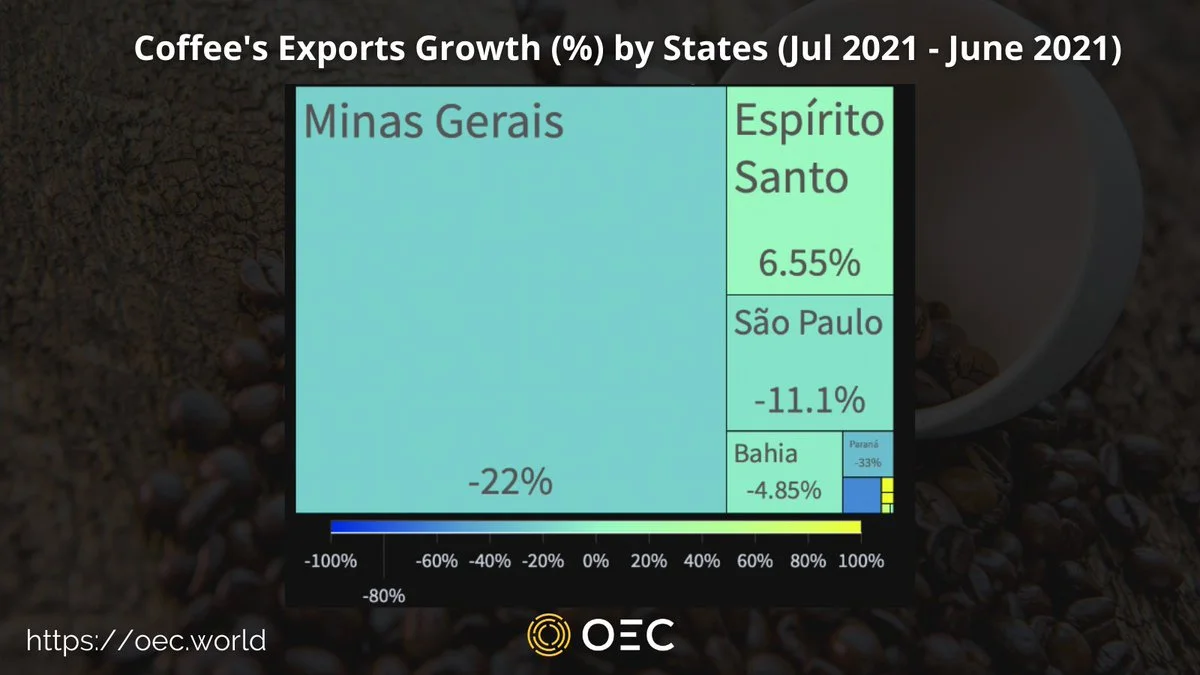

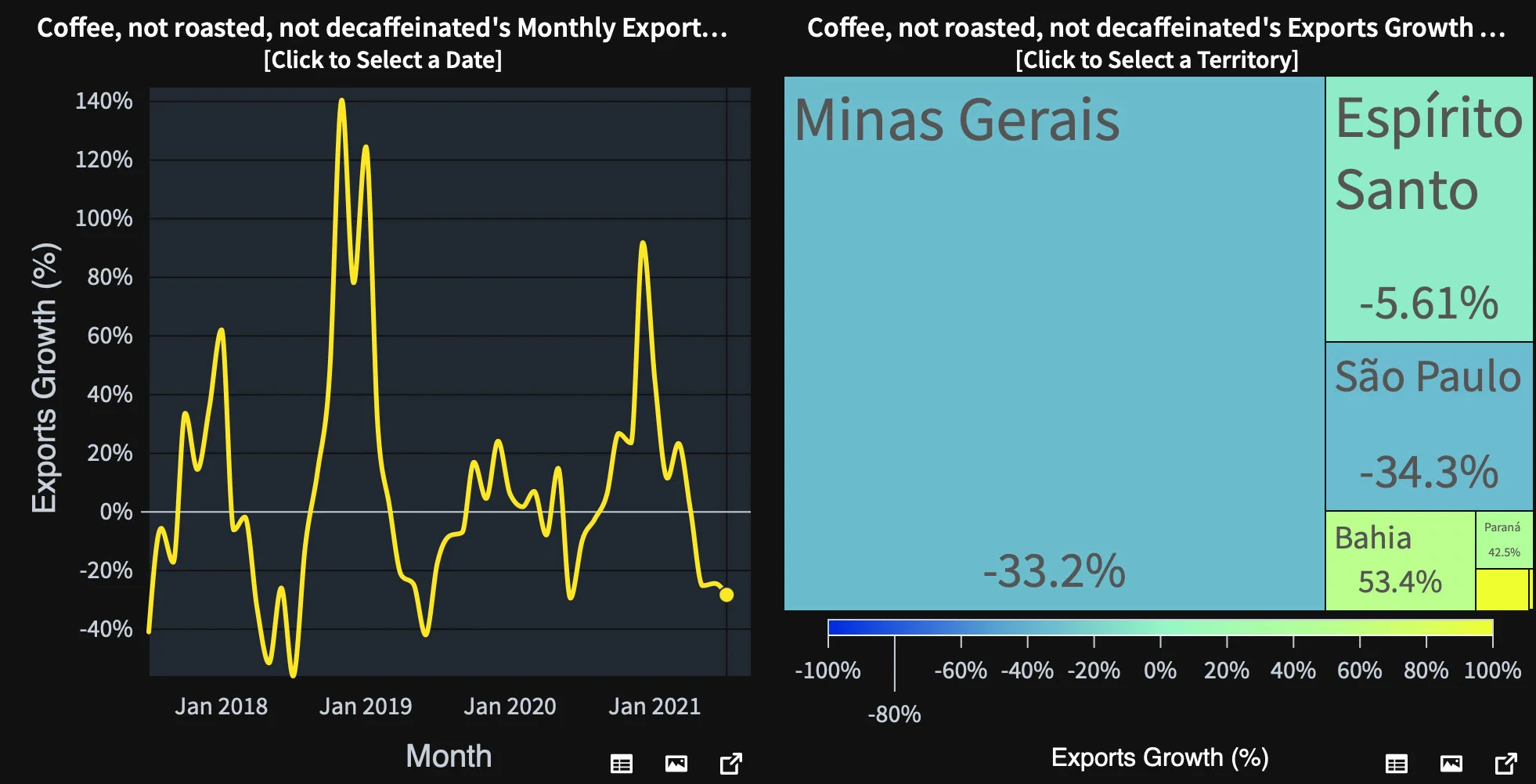

In Brazil, Arabica production is located in the states of Minas Gerais, São Paulo, and Bahia. Robusta is almost exclusively grown in the state of Espírito Santo. During the last six months, only the state of Espírito Santo has grown its coffee exports in Brazil.

Brazil's decline in coffee exports comes with a decrease in Arabica production during the last years. According to the US Department of Agriculture database, Brazil’s Arabica production is expected to drop by 30% this year, while Robusta will grow by 5 percent.

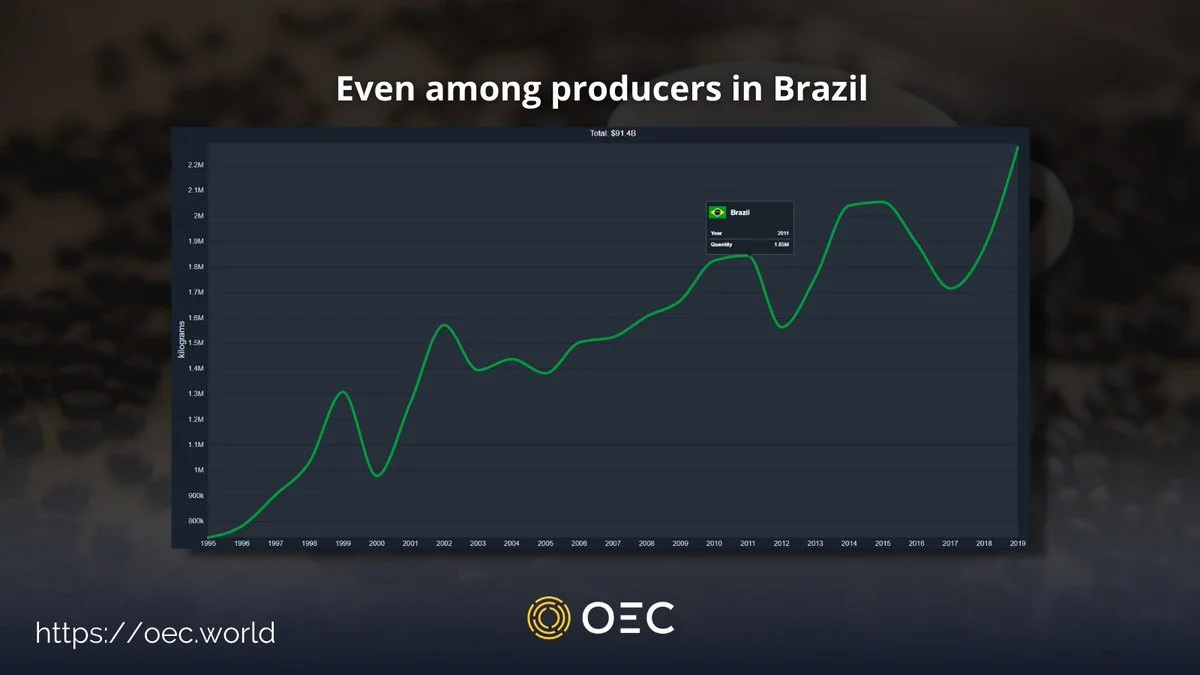

This year, Brazil's Arabica production will reach the same levels as 2011, when the price of coffee peaked. In 2011, Arabica production in Brazil declined 17%, while Robusta increased 14%.

Along with Brazil, Vietnam, Colombia, Indonesia, Ethiopia, Mexico, Central America, and Uganda produce 90% of the world’s coffee. Colombia, Ethiopia, Mexico and Central America yield mostly Arabica. Vietnam, Indonesia, and Uganda grow mostly Robusta.

Even in Brazil, Robusta is gaining ground among producers. In 2011, 30% of total production was Robusta. This year, it will be 40%.

Robusta has been traditionally viewed as inferior to Arabica and thus only fetches a fraction of the cost. Its characteristics have also make Robusta a good option for consumers with a taste for espresso or instant coffee.

Something to be seen is the effect that changes in Arabica production would have on trade and prices of coffee this time around. Demand and price elasticity in 2021 are not the same as in 2011. From a trade perspective, it seems that over the years most people have gradually altered the flavor of their coffee. Not all coffee blends have to be 100% Arabica. Even in the United States, taste for coffee may be evolving.

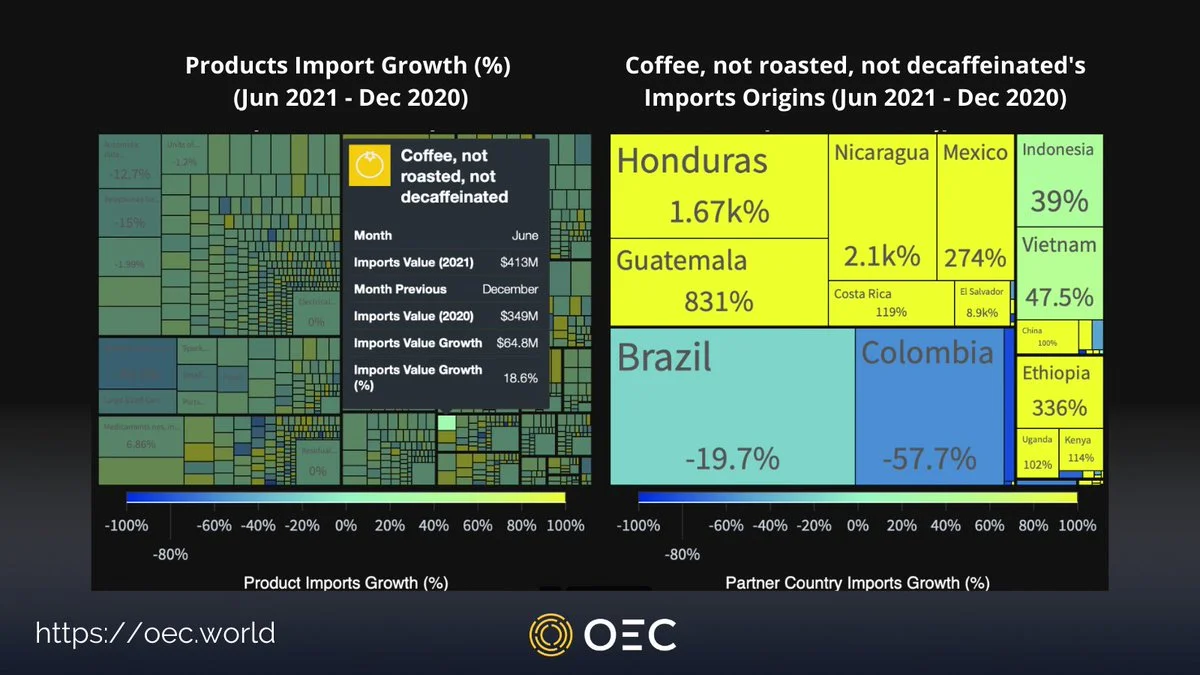

Recent trade data shows the US is substituting coffee imports from Brazil and Colombia with imports from México, Central America, Ethiopia, Kenya, and China (all Arabica producers). However, Indonesia, Vietnam and Uganda are also increasing exports of Robusta to the US.

Robusta is a more caffeine-charged variety, and that’s what we might need now. Yes, it’s also bitter, and that’s what we might need also. Are we willing to give Robusta a chance? Pricier blends dominated by Arabica and a warmer climate could be the push we need to adapt. Climatically, thanks to Robusta, we might not have to cut back on our morning coffee.